C2模拟题(三)

Question 21

On 1 May, A pays a rent bill of $1,800 for the twelve months to 30 April. What is the charge/credit to the income statement for the year ended 30 November?

Question 22

A car was purchased for $12,000 on 1 April in year 1 and has been depreciated at 20% each year straight line, assuming no residual value. The company policy is to charge a full year‟s depreciation in the year of purchase and no depreciation in the year of sale. The car was traded in for a replacement vehicle on 1 August in year 4 for an agreed figure of $5,000.

What was the profit or loss on the disposal of the vehicle in year 4?

Question 23

The following information relates to M: At 30 September

Year 2 Year 1

$000 $000

Inventories:

Raw materials 75 45

Work-in-progress 60 70

Finished goods 100 90

For the year ended 30 September Year 2

$

Purchases of raw materials 150,000

Manufacturing wages 50,000

Factory/production overheads 40,000

What is the prime cost of production in the manufacturing account for year 2?

Question 24

A company bought a machine on 1 October year 1 for $52,000. The machine had an expected life of eight years and an estimated residual value of $4,000. On 31 March year 6, the machine was sold for $35,000. The company‟s yearend is 31 December. The company uses the straight-line method for depreciation and it charges a full year‟s depreciation in the year of purchase and none in the year of sale.

What is the profit or loss on disposal of the machine?

A. Loss $13,000

B. Profit $7,000

C. Profit $10,000

D. Profit $13,000

Question 25

N purchased a machine for $15,000. The transportation costs were $1,500 and installation costs were $750. The machine broke down at the end of the first month in use and cost $400 to repair. N depreciates machinery at 10% each year on cost, assuming no residual value.

What is the net book value of the machine after one year?

A. $13,500

B. $14,850

C. $15,525

D. $15,885

Question 26

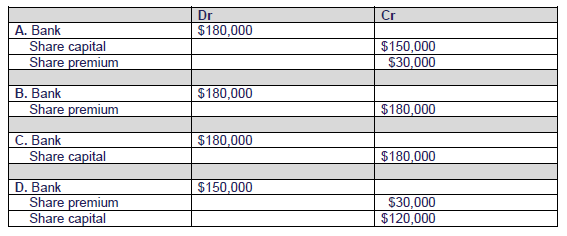

B made an issue of 150,000 $1 ordinary shares at a premium of 20% the proceeds of which is received by cheque.

What is the correct journal to record this?